Drivers: You need to get ready for IR35

New rules may mean changes to how you get paid

Are you a LTD Company Contractor?

Changes to the Government's IR35 legislation will come into force in April 2020, preventing larger haulage companies from taking on drivers who work as Ltd Companies. Instead, you'll need to be employed as a PAYE worker - either as part of a haulage company's permanent driver pool or on your agency's payroll. You'll still be able to work through your agency's Umbrella scheme as a PAYE worker.

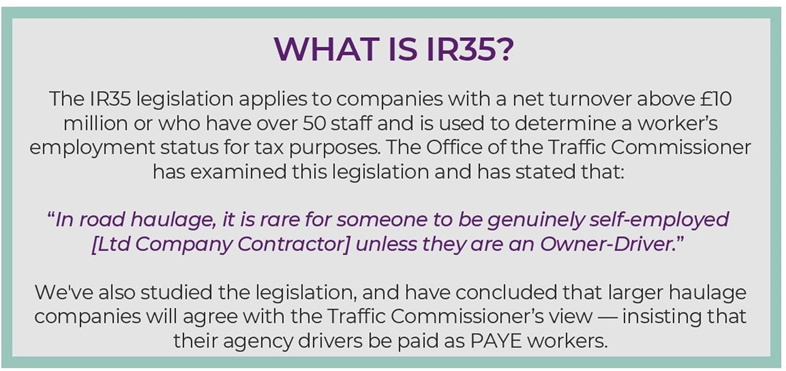

Why IR35 Affects You

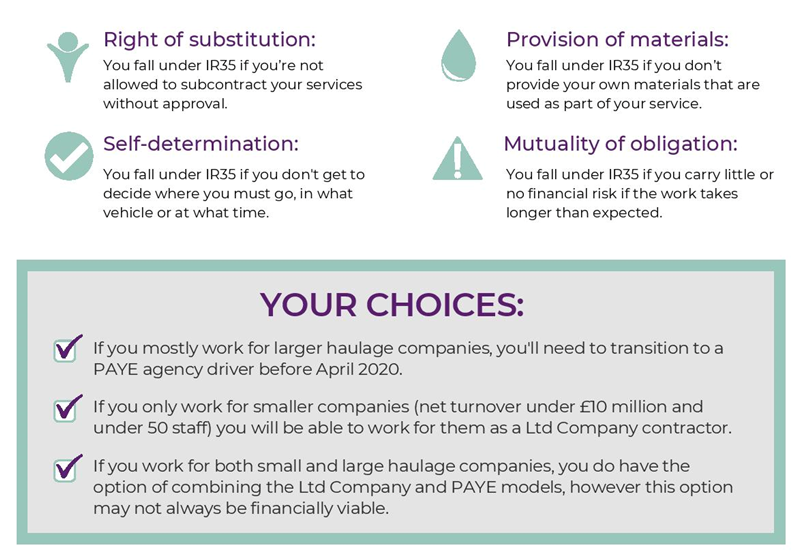

There are several criteria you must meet to legally continue trading as a Ltd Company contractor. We've listed four of these criteria below to help you understand why, as an agency driver, you fall under IR35 and will likely need to move to a PAYE model:

We're in your corner

Our team is working really hard to negotiate new and improved PAYE rates with our clients so that we can offer our PAYE drivers the same level of net (after tax) pay they would get operating as Ltd Company contractors.

If you have any questions or would like to discuss the changes in more detail, we're more than happy to talk you through the options and, where applicable, guide you through the steps to transfer over to PAYE.

For more information please check out our IR35 White Paper

Our doors are always open! Contact your local branch for help and advice

Stevenage Branch / T: 01438 722800

Tamworth Branch: T: 01827 370260

Northampton Branch: T: 01604 648444

St Albans Branch: T: 01727 614140

Andover Branch: T: 01264 883168

Braintree Branch: T: 01376 525725

Dartford Branch: T: 01322 466541

Google Reviews

-

Dave GallacherGood range of jobs available, decent rates of pay. Always able to get in contact with the office or someone on call with good knowledge and understanding of the job or role sent to. Never had an issue with pay, easy timesheet process

Dave GallacherGood range of jobs available, decent rates of pay. Always able to get in contact with the office or someone on call with good knowledge and understanding of the job or role sent to. Never had an issue with pay, easy timesheet process -

(1).png?r=a2-s120.120-o) Ionel Lucian DinicaVery easy to find work , very nice and kind staff, all details explained very easy. Highly recommended.

Ionel Lucian DinicaVery easy to find work , very nice and kind staff, all details explained very easy. Highly recommended. -

Catalin SirgheA reliable and efficient agency. I’ve had a positive experience with Driver Require. They have consistently paid on time and have never cancelled a shift. The communication is excellent. If you’re looking for a reliable agency that values its drivers, Driver Require is a great choice.

Catalin SirgheA reliable and efficient agency. I’ve had a positive experience with Driver Require. They have consistently paid on time and have never cancelled a shift. The communication is excellent. If you’re looking for a reliable agency that values its drivers, Driver Require is a great choice.