Six year recovery predicted for LGV driver & haulage sector

The effect on Haulage industry will be exaggerated compared to other sectors

Expert economists are comparing the current crisis to the Great Recession as well as the economic conditions following the Second World War. There is also much speculation about how the impending recession will pan out, with a veritable alphabet of what sort of shape it will take: V-shaped, W, U or L.

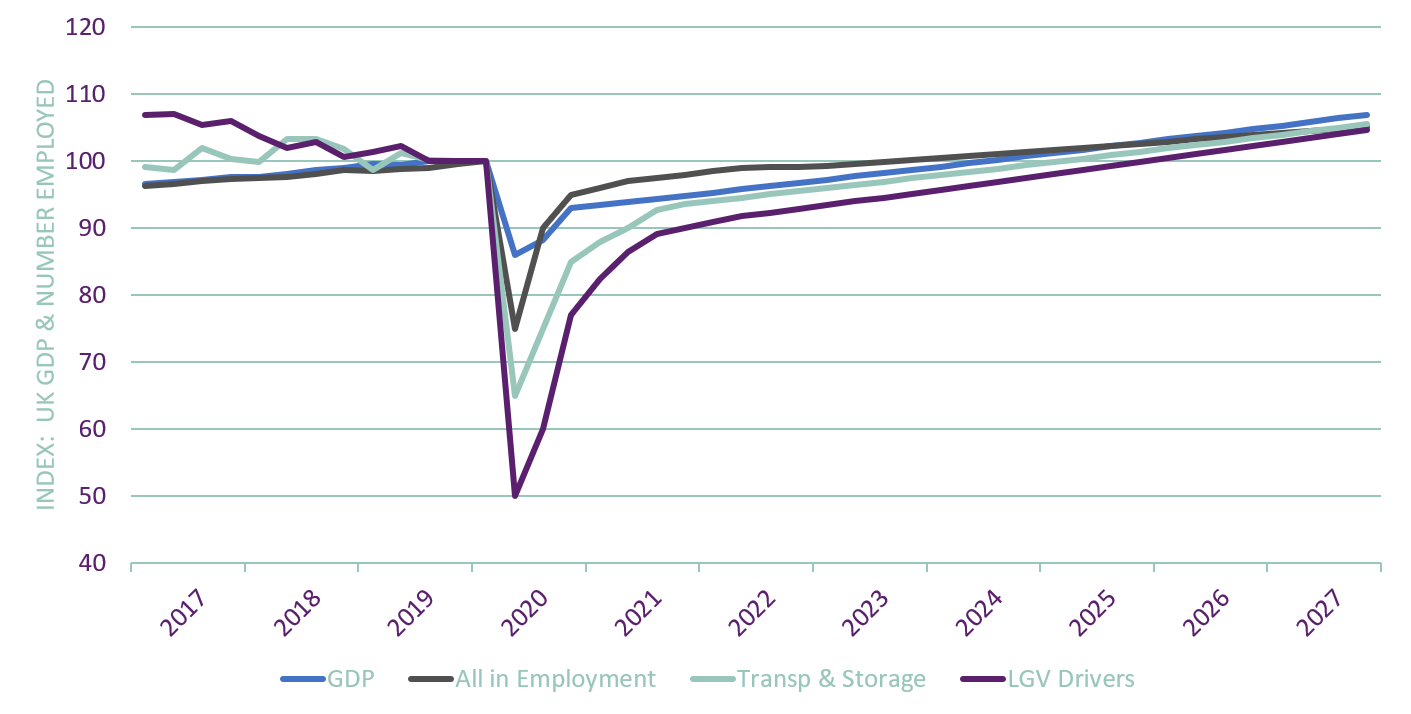

The important thing for us in the UK Haulage Sector is how it will affect us and, from our own interest as a temporary driver supplier, how it will impact employment numbers in the logistics market. If it’s anything like the Great Recession of 2008, the effect on the Haulage Sector will be exaggerated compared to other sectors. Our predicted recovery period of 6 years from the start of the crisis for both LGV Driver and Transport & Storage employment numbers correlates with the observation that during the 2008 Great Recession it took 50% longer for this sector to recover than for GDP.

In Section 2 of our recently published Report: The Impact of COVID-19, we observed that a -6.3% drop in GDP produced a drop in “Transport and Storage” employment of 2 times the GDP % drop, and a fall in LGV driver employment of approximately 2½ times the GDP % drop.

The time for the Transport and Storage sector, including LGV drivers, to recover was around 1½ times the time it took for the overall economy to recover.

We have assumed that GDP drops by -14% in Q2 then rises to a total 2020 GDP of -7%. Subsequently it rises at 0.5% per quarter, which equates to 2.0% per annum.

Using these assumptions, we have modelled a possible recovery scenario in the graph below:

This would lead to GDP returning to pre-crisis levels by mid-2024, i.e. it takes 4 years to recover. Remember that this is our “Average” case scenario and should be considered against the backdrop of much more drastic forecasts including the OBR’s “reference” scenario of a -35% drop in Q2 GDP and a -13% fall in 2020 annual GDP.

We can therefore predict how Transport & Storage, and more granularly the LGV driver employment numbers will evolve as we come out of recession.

All in Employment:We assume a -25% drop in total employment during the lock-down, recovering to about a -5% drop by the end of 2020, then rising slowly to regain its pre-crisis level by the end of 2023. Essentially 3 and half years to recover from the crisis. We believe this is consistent with the ONS UK survey of businesses in April, which indicated that 40% of businesses reported laying off staff in the short term and 30% had reduced working hours. We then assumed that many businesses are furloughing or laying off only a proportion of their staff, so we would not experience the full 40% drop in employment numbers. |

Transport & Storage:We assume a -35% drop in employment in the Transport and Storage sector during the lock-down. This also correlates with the ONS UK survey of businesses in April, which indicated that 54% of Transport and Storage businesses were laying off (furloughing) staff and 39% reducing working hours. We assume this rises quickly, as the government relaxes the lock-down restrictions, to a net drop of -15% by the end of 2020. Employment in this sector rises to 5% below pre-crisis levels at the end of 2021 and then recovers slowly over the following 5 years. This compares with a protracted (5+ years) drop of -14% during the 2008 Great Recession caused by an overall GDP fall of -6.3%; we therefore believe our assumption is conservative.Specifically, looking at the current circumstances, we think it is consistent with a potentially significant drop in business volumes due to delayed manufacturing recovery, as well as numerous business closures and continued restrictions on trading in the recreational and catering sectors. Thereafter employment numbers are assumed to rise gradually, though held back by the global recession, to eventually achieve pre-crisis levels in mid-2026. |

| LGV Driver Employment:We assume a -50% drop in LGV driver employment numbers based upon the claim that -49% of the UK fleet is standing idle during the lock-down. These then rebound to a -23% drop by the end of the year as haulage companies reactivate. As happened during the 2008 Great Recession, we expect recovery of LGV employment numbers to lag 3 to 6 months behind the overall Transport and Storage sector. LGV employment will continue to rise to around 10% below pre-crisis levels by mid-2021 as manufacturing and construction activity ramps up, then it levels off to rise gradually to achieve pre-crisis levels by the end of 2026. |

We may be looking at an average 10% drop in LGV driver employment, equating to around 30,000 driver positions, for several years following the crisis, as the global economy recovers. This is expected to partially offset the perceived current UK shortage of around 50,000 LGV drivers.

Our key conclusion is that it is now unlikely there will be a chronic shortage of LGV drivers once we are beyond the steep recovery “bounce” that follows the relaxation of lock-down. In fact, we expect there to be a surplus of LGV drivers in the UK that will naturally achieve equilibrium levels during 2021. Only once business activity returns to pre-COVID-19 levels can we expect LGV driver numbers to become a constraint and we can re-start our discussions about how to tackle the underlying driver shortage.

Read more in our free report here

Google Reviews

-

Dave GallacherGood range of jobs available, decent rates of pay. Always able to get in contact with the office or someone on call with good knowledge and understanding of the job or role sent to. Never had an issue with pay, easy timesheet process

Dave GallacherGood range of jobs available, decent rates of pay. Always able to get in contact with the office or someone on call with good knowledge and understanding of the job or role sent to. Never had an issue with pay, easy timesheet process -

(1).png?r=a2-s120.120-o) Ionel Lucian DinicaVery easy to find work , very nice and kind staff, all details explained very easy. Highly recommended.

Ionel Lucian DinicaVery easy to find work , very nice and kind staff, all details explained very easy. Highly recommended. -

Catalin SirgheA reliable and efficient agency. I’ve had a positive experience with Driver Require. They have consistently paid on time and have never cancelled a shift. The communication is excellent. If you’re looking for a reliable agency that values its drivers, Driver Require is a great choice.

Catalin SirgheA reliable and efficient agency. I’ve had a positive experience with Driver Require. They have consistently paid on time and have never cancelled a shift. The communication is excellent. If you’re looking for a reliable agency that values its drivers, Driver Require is a great choice.